When I first discovered Yu-kai Chou’s Octalysis framework, shortly after he published ‘Actionable Gamification’, I knew straight away that I would find it an invaluable tool, not just to help me design learning with learner motivation in mind, but also as a way of evaluating and improving existing learning experiences.

The very first such analysis I attempted was of a learning programme that I had not designed, but was heavily involved in delivering. This article is a description of that experience. It is not intended to be an in-depth explanation of Octalysis – it is best to go straight to source for that. The Octalysis Group provide some outstanding learning. Nor is it intended to be an in-depth analysis of the learning programme I evaluated. It is a description of an experience, along with some commentary about what I discovered about how to use Octalysis, and the Player Type Hexad (not part of the Octalysis framework). I hope it will be useful if you are planning to use the same tools, or if you need to undertake a similar analysis.

A brief overview

Some small explanation is however necessary before continuing, specifically about the eight ‘core drives’ (CDs), and two ways of categorising those drives:

CD1 Epic Meaning & Calling – The motivational drive whereby participants feel called to become involved in something greater than themselves. This is the drive which is in play when people become involved in a cause.

CD2 Development & Achievement – The motivational drive whereby participants are driven by a desire to make progress or to achieve something.

CD3 Empowerment of Creativity & Feedback – The motivational drive whereby participants feel more drawn to complete an activity if they have autonomy to approach it creatively, by, for example, trying a new approach.

CD4 Ownership & Possession – The motivational drive whereby participants are driven by a desire to acquire something, to possess it, or even to improve things they already possess.

CD5 Social Influence & Relatedness – The motivational drive to be connected to others, to gain status and recognition or approval, or to help others

CD6 Scarcity & Impatience – The drive which makes you want something simply because you cannot currently have it, or because it has rarity value.

CD7 Uncertainty & Curiosity – The drive to explore and find out. The pleasure of surprise.

CD8 Avoidance & Loss – The drive where participants will do something simply because the they fear the consequences of not doing it.

Black Hat / White Hat – A way of viewing the eight drives as being either empowering (white hat) or manipulative (black hat). 1,2 and 3 are seen as WH and 6,7, and 8 as BH. The remaining two drives could be either depending on specific outcomes or implementation.

Left Brain /Right Brain – A way of viewing the eight drives as being either extrinsic (Left) or intrinsic (Right). 2, 4 and 6 are seen as LB and 3, 5 and 7 as RB. The remaining two drives could be either depending on specific outcomes or implementation.

The deliverables of the process

Octalysis offers up to five levels of analysis, but I believe that for most people’s purposes, it is sufficient to undertake just the first three levels. These will give you, by the end of your analysis process:

- An overview of how well your analysed experienced satisfies each of eight core motivational drives.

- That same experience split into four stages, reflecting the different motivational requirements of an experience as it passes from beginning to maturity

- Those four stages further subdivided by six different personality types (because of the player type model I have chosen – others are available), giving a matrix of 24 smaller experiences

The outputs from this process therefore give you some very granular feedback on how likely people are to want to take part in your experience, which is an excellent basis to start thinking about how that experience might be amended to make it more compelling, enjoyable and thus to maintain participation.

Throughout the analysis one needs to make judgments on how well your experience meets particular criteria. The ideal situation would be that you have hard data on which to make those judgments, but that is not always possible. My experience was a corporate sustainability learning programme and I had post programme evaluation forms and the results of a participant survey, taken six months after the programme. I also used discussions with colleagues and my own experience of the programme in my evaluation.

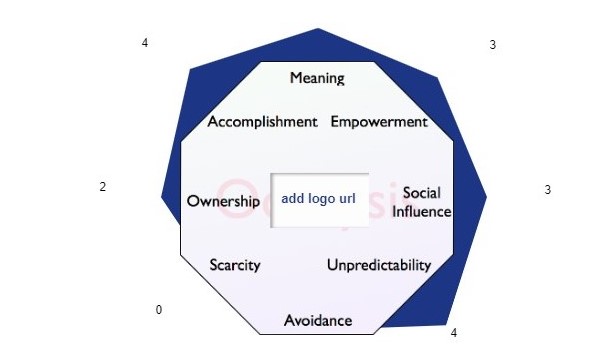

Based on these judgments, one assigns a value of between 0 and 10 to each of the drives. For example, in the diagram below, I assigned a value of 7 to Epic Meaning and Calling (Core Drive 1) and 3 to Unpredictability and Curiosity (CD7)

This is what I found, in general terms, as it would not be appropriate to reveal the details of the programme itself. This article is more about the experience of using the tool than the result of my analysis.

Level I analysis (115)

The Octalysis score, in this case, 115, is derived from the sum of the squares of the values assigned to each of the drives. It provides a gross summary of the ‘strength’ of the experience, but cannot really provide any insight beyond that. It is much more revealing to look at the balance between Black vs White Hat drives (the top three CDs vs bottom three in the diagram), and Left vs Right Brain (three leftmost vs three rightmost), as well as getting a picture of which drives are particularly well or badly served by a particular product or experience.

Looked at in this way, it seems to be a reasonably strong experience, but there is some imbalance. It is skewed both towards White Hat and Right Brain drives, meaning that it shoud be an intrinsically rewarding experience, and also empowering, participation in which will make people generally feel good.

However, the lack of Left Brain drives may make the experience less appealing to those who are driven by Achievement (CD2) and Ownership(CD4) , for example, or require other ‘logical’ justification to attend. It fails to answer the question ‘What’s in it for me?’ (WIIFM). Likewise, the emphasis on White Hat drives means that participants will derive feelings of wellbeing and satisfaction from their participation, but may lack a sense of urgency to carry out any of the desired actions. Bluntly put, although they may know that they are taking part in a meaningful activity CD1), if they get a better offer on a day when they are due to do so, or something is seen as a barrier (inconvenience (CD8), lack of time (CD6)), they may well decide to miss the action. There are no negative consequences to NOT acting.

Imagine an individual who needs to complete a self-assessment tax return. She knows that it is a good idea to complete the task, and that she will get a feeling of accomplishment and relief when the troublesome task is out of the way. Ultimately though, it is the prospect of a £100 late payment penalty and the unwelcome attention of HMRC which motivates her to submit her return, the day before the deadline. Deadlines are a very good example of Black Hat motivation CD8 – Loss and Avoidance.

The programme instils a sense of purpose and agency (to a certain extent), but does not sufficiently push people towards exercising that agency to reach that purpose.

Level II

Discovery (61)

During the Discovery phase you must convince people WHY they want to participate in what you have to offer. Whether they reach the end of this stage and sign up to your product or experience will depend on how well they feel their own particular drives are satisfied during this awareness raising phase.

In the Discovery phase, thought must be given to how you can market your experience to emphasise Curiosity and Unpredictability (CD7), so that people will feel driven to find out more, Epic Meaning & Calling (CD1), so that people feel that they will be becoming involved in something worthwhile, and perhaps Social Influence & Relatedness (CD5) if you people to virally spread awareness of your product or experience.

The experience is notably weaker in its Discovery phase than when viewed as a whole. It is particularly noteworthy that it is very heavily skewed towards Right Brain drives. While it could be considered ‘better’ to design an experience which is intrinsically motivating, extrinsic motivation can be very motivating for those looking for a ‘convincer’ (again – WIIFM?).

There is also an emphasis on White Hat Drives, just as there was in the overall Level I diagram. This indicates that while the Discovery phase is rich in meaning and conveys a feeling of something that it ‘worth doing’, it may lack the appropriate Black Hat ‘call to action’ that will actually make people sign up to attend the training experience.

Onboarding (151)

Once the participant has signed up to your experience, you must teach them how to interact with it; how it works, and the tools they will need to navigate through it. This stage ends once these basic skills are in place and participants have reached the early win-states.

Within this programme, this stage is largely covered by face-to-face learning days, but will continue into their first uses of a website, and their first ‘solo’ actions, following the activities they have been trained to carry out (if either of these things even occur). Not all participants will undertake all of the elements offered, as some may drop out after training, or more rarely, may not turn up for training at all.

Onboarding appears to be a relatively strong experience, compared to Discovery (and as we shall see, Scaffolding and the Endgame) and this bears out our observations of running the programme. We get very positive feedback from people who attend the face-to-face learning days. People feel they have learned a lot (CD2); they feel positively motivated to make lifestyle changes (CD1, CD3) and they find the active learning component engaging and thought provoking (CD1). However, we do seem to face challenges in funnelling people through to this stage, with many days having to be cancelled because of poor recruitment. Although there is still an emphasis on Right Brain drives, this is less pronounced than previously, and the scores on all drives are better than before.

We are also seeing for the first time in the journey, an opportunity for those who focus on achievement to satisfy some of their needs. There are many and various things to do and learn during the training, giving numerous opportunities for participants to feel that they have gained knowledge or skills, or have reached new insights (CD2). It is also a social experience, and this can be very motivating (CD5). CD1 is particularly strong during the face-to-face experience, as people learn about specific complex challenges, and also how they can become part of the solution.

Scaffolding (107)

Once participants have the basic skills to interact with your experience and they have reached the first major win-state, they enter the Scaffolding phase.

This is where they carry out the normal activities which make up your experience. It is ‘Business as Usual’. One aspect of this which can therefore be problematic is that you may be asking people to carry out the same actions repeatedly, and you must ask the question ” Why would our participants keep coming back to do this?”

In the programme, this is the crucial time when we leave participants to their own devices. They will be using the techniques which we taught them on the training day, but on their own in their own time. We hope they will be spreading the word about what they have learned, encouraging their colleagues to attend, and telling their friends and families about relevant issues, as well as encouraging behaviour change. We want them to participate in the learning community via the website. We send them information now and again to keep them up to date with what is going on.

Again, we find ourselves a bit thin on Black Hat drives. The feeling of wanting to do good persists (CD1), but where is the ‘prod’ to make sure that happens. Our surveys have shown that a key motivation in those who continue to participate in this stage is the fact that the activities can be social (CD5), and those who receive regular feedback from their organisational rep (CD5, CD7) also remain more engaged for longer. But for many, their action becomes a solitary activity, once they are out of the Onboarding phase, meaning that this drive has less influence.

There are ways of achieving (CD2), gaining more knowledge, completing learning modules and so on, but many respondents report that they have never visited the learning materials on the website or do not know where they are. Again, although the White Hat drives have potential, the signposting and the Black Hat ‘prod’ to get participants to engage with the activities which satisfy these drives is lacking.

End Game (38)

Once people feel that they have done everything your experience has to offer at least once, they need to be convinced to continue interacting with your experience – well at least if you have a need for long-term enagagement. Never forget that by this time, newer alternatives for other experiences will have been dangled in front of them. You need to ask why they would not leave your experience to pursue these instead.

If you do want long-term you need to design in ‘evergreen’ activities which keep your participants for the foreseeable future.

In the Endgame, we see a drastic falling away of the satisfaction of nearly all the drives. There is nothing new in this stage, just a continuation of the activities which the participants have carried out in the Scaffolding stage. This is therefore by far the weakest point in the journey. Participants can continue to act and use the website, but they have exhausted many of the ‘finite’ aspects of the programme. They have probably ‘converted’ all the friends and family they can. If they have engaged with the website, they have probably exhausted the material there or ceased to engage if they did not find it compelling. Even CD1 will become less motivating over time, unless the participants receive regular feedback which shows them the impact of their activities. And we know from feedback that this is potentially a problematic area, with many people unsure about why they are performing certain actions or what impact they are having.

In short, the Level II analysis shows us an experience which is strong in the face to face component but which struggles for initial sign up and maintaining long term engagement.

Level III

Level III Octalysis takes the four stages of level II and further subdivides them by overlaying player types, because the player type framework I have chosen consists of six player types, in a full analysis this level would consist of 24 separate diagrams with analysis, but I will just show a representative example from each stage in this article. This required the use of a third party player type model as Octalysis did not have its own player type framework at the time I did this analysis.

The diagrams below show the ‘shape’ of the experiences at that stage, for that specific player type.

Octalysis analysis for player types

I have chosen to use Andrzej Marczewski’s six player types, as these are considered more suitable for gamification in the workplace than Richard Bartle’s four player types (upon which Andrzej’s work is based).

Disruptor

Disruptors are motivated by Change. They want to effect (hopefully) positive change, but possibly negative change by interacting with your experience.

There are 4 sub types in Andrzej’s model. We do not want Griefers or Destroyers in our system. We must either convert them to the two more positive types, or get rid of them as their influence is wholly negative and destructive. Therefore the below diagrams consider only the drives which appeal to the subtypes Improver and Influencer. These two player types favour

- Improver – they like to explore a system and find ways to make it better. They are disruptive problem solvers

- Influencer – they like to changes things by using their influence over others.

Disruptors are largely driven by CD2 and CD4, but also CD3, CD5, and to a lesser extent by CD8.

Discovery – for a Disruptor (29)

For Disruptors, the Discovery Phase of the programme is not a strong experience. There is really nothing for them currently in their key drives around Accomplishment (CD2) and Ownership (CD4). They may see opportunities to increase their influence through CD5, but only in a specific set of circumstances where there is strong line manger pressure / support to attend, or where they are a team leader. CD1 and CD8 may well appeal, but in this case would be reliant on feeling of agency that they can enact change, as well as a prior interest in enacting change of the kind offered by this learning programme, which may not be their area of interest.

Philanthropist

Philanthropists are motivated by Purpose and Meaning. They want to ‘do good’ and do not expect rewards for doing so. They are most driven by CD1, but to a lesser extent by CD2, CD3 and CD5.

Onboarding – for a Philanthropist(196)

Perhaps unsurprisingly, Philanthropists have the strongest experience of all the player types, and it seems markedly more balanced than the experiences of other player types in terms of Left/Right and Black/White. CD1 still tops the list of their drives for participating, but the other drives support their purpose strongly too. CD3, Empowerment of Creativity and feedback is one of the weaker drives across the board, as there few ways to express creativity during the training. Although CD3 is something which Philanthropists would like in an experience, its lack is more than made up for by the strong reinforcement that participation will help. It is only later on in the experience where the lack of options to do so creatively may become something that causes even Philanthropists to disengage.

Free Spirit

Free Spirits want autonomy to create and explore. Self-expression is also important to them. CD3 and CD7 will drive them most strongly, but also CD2 and CD6 to a certain extent.

Scaffolding – for a Free Spirit (63)

Given the ’finite’ nature of the activities offered in the Scaffolding stage, many Free Spirits may fall away once they have explored the website a bit, or maybe posted one or two blogs. The activities may engage initially as they will be keen to explore (CD7) options to use the activities in their local environment, but if the experience does not change from one visit to the next, they may lose interest, and find reasons to cease participating, especially given the lack of other Black Hat drives which might give them the impetus to carry on.

Socialiser

Socialisers want to interact with other people and make connections. Mainly motivated by CD5, they also favour CD3 and CD7, or even CD4 (‘my’ friends).

Discovery – for a Socialiser (37)

The Socialiser is second only to the Philanthropist (in terms of raw ‘score’) in how appealing they find Discovery. Particularly if they are to attend a team day, or if they have a personal recommendation (CD5), they are likely to be interested in signing up. However, like the Philanthropist and the Free Spirit, they may struggle to find a firm Left Brain reason to convince either themselves or others that they should attend.

Achiever

Achievers are motivated by Mastery, wanting to learn new things and improve themselves. They need to feel they are overcoming challenges. Achievers are obviously strongly driven by CD2, and CD4 and CD6 will also influence them. They will also enjoy finding creative ways to achieve (CD3)

End game – for an Achiever(22)

It would be surprising if we retained many Achievers into the End Game, unless they are embedded within a Sustainability function in the business or see professional opportunities in that area. The total lack of any Black Hat ‘calls to action’ will be the death knell for the influence of the very weak White Hat drives we see here.

Player

Players are motivated by Rewards. They will do what is needed of them to collect rewards from a system. They are in it for themselves. Their primary drivers are CDs 2 and 4, and to a lesser extent 6.

Onboarding (51)

The experience becomes slightly better for Players, as it does for all our player types, once they attend the face-to-face event. However, the total lack of Black Hat drives will probably mean that they are deciding, even during the day itself, that their participation will end there. The only exception will be if they see scope for professional advancement or recognition, which will only occur in specific circumstances related to their work, so cannot be relied upon as general motivation for all participants who favour this player type.

Review of my experience of Octalysis analysis

Level I is interesting as an overview but it of little use as an analysis tool. The usefulness increases exponentially with the addition of Levels II and II, and these enabled me to see very clearly where the issues were with the current experience. That clarity in turn, makes it a relatively easy task to then make concrete recommendations for how an experience can be tweaked. I include a sample of the findings and recommendations I made to illustrate this part of the process.

Level I – overall experience

While the overall score shows a reasonably strong experience, the programme is a markedly White Hat /Right Brain experience, which indicates that we may need to ensure that participants can see sufficient ‘rational’ justification to participate – especially given that the target audience comprises busy corporate employees, and that there are sufficient compelling ‘calls to action’ to drive them successfully through the experience. The graph shows that the overall experience is about ‘for good’ actions and behaviour changes and personal learning, with a potential strong social element. We have to ask ourselves about how generally relevant those themes and aspects are, given that they are attending in their capacity as employees.

Level II – Journey

Discovery phase

This phase is particularly lacking in the Left Brain, logical drives. Again, given our audience, who work in a competitive corporate environment, are we doing enough to convince them that this is an experience which will bring them benefits that are relevant to that role, rather than just a ‘nice to have’ experience which satisfies personal curiosity and social opportunities?

Onboarding phase

Much stronger than the other phases, we can be confident that for the majority of our attendees we have crafted an enjoyable, thought-provoking experience (some exceptions do suggest themselves in Level III). Even this phase is somewhat lacking in the Left Brain drives, and there is also a marked lack of opportunities for participants to be creative in how they approach the experience.

Giving our participants more autonomy and potential for creativity (CD3) in how they approach the programme would help us to provide effective differentiation of the central experience, also increasing the ways in which they can achieve (CD2) outcomes that are particularly relevant to them, thereby allowing a greater feeling of ‘ownership’ (CD4) over their participantrole

Scaffolding phase

The attrition that we see in activities might be in part attributable to the lack of Black Hat ‘calls to action’ once the participants are left to their own devices.

We could improve this experience considerably, driving greater retention and more desired actions, if we built a journey incorporating Black Hat mechanisms which act as the immediate driver to carry out desired actions (activities that were trained for, participating in community platform),leading to Win-states replete with White Hat rewards to reinforce the benefits of carrying out those actions.

End Game phase

A properly designed End Game could increase our current ‘Star’ cohort beyond those who have a pre-existing interest in the environmental theme of the programme, which would in turn increase the impact we are able to have by letting us move beyond ‘preaching to the converted’.

Level III – Player Types

Disruptor

The main confounding issues for a Disruptor of the experience are that we do not currently articulate very well how participation in the programme enacts change or how participants have agency. Once participants have been through the face-to-face training it is unclear how they would be able to link their actions to changes in,e.g. policy or land management. A Disruptor would need to be able to see these connections to remain engaged.

Their experience is one of the weakest in the Discovery phase but one of the strongest in Scaffolding, so we are probably currently failing to recruit people who could be very engaged. We need to spot and take opportunities throughout the experience to strengthen our evidencing (and feedback) of positive impacts and change.

Philanthropist

Philanthropists have the strongest experience of the programme, which is maybe not surprising, but this could still be strengthened particularly in Scaffolding and the End Game to include more Black Hat ‘calls to action’. A similar lack of a ‘prod’ in the Discovery stage may lead to many Philanthropists not signing up at all – a missed opportunity which we must address.

Free Spirit

Free Spirits may feel very drawn to participate but find themselves lacking a rationale to do so, given the other demands on their time. The lack of creative ways to interact with the experience, and a lack of novelty in activities may well drive them away early, especially considering the lack of Black Hat inducements.

Greater creative opportunities and ‘new’ discoveries throughout the journey would help to keep this player type on board.

Socialiser

Socialisers have a similar experience to Free Spirits – wanting to participate (especially in team days), but finding it hard to justify either to themselves or others. The social potential is great, but we need to ask ourselves ‘Why this programme?’ as there will probably be rival social-based activities they could participate in if they wanted to.

We need to more deeply embed the social benefits of participation, making the two things far less easily decoupled. For example, many cite the sustainability actions offered by the programme as an enjoyable way to spend time with family, but they could just as easily do the same walk to the same location with the same family members, deriving the same pleasure, even if they did not carry out the activity.

Achievers and Players

Achievers and Players are the two player types least well served by the current experience, and my feeling is that this is a particular problem given our audience (ambitious corporate employees). It is quite likely that many ambitious corporate employees do show characteristics of these two player types. It is likely that they are concerned about their careers, their material possessions, their professional reputations and development and any number of other aspects which relate to CDs 2, 4 and 6, the Left Brain drives, which we do less well in the programme.

That this issue has not manifested itself in feedback and surveys, may be a sign that it is not a problem, but my feeling is that the lack of evidence of this shortcoming may very well be because very few of these player types sign up in the first place. The Discovery phase is particularly weak for these player types, with no Black Hat ‘calls to action’ at all.

If we want to show ROI to corporates, these are exactly the people who should be attending our programmes – the high flyers, the future general management.

Our programmes need to be linked to relevant business-based achievements and rewards to attract and retain these player types.

- James Bore – The Ransomeware Game - 13th February 2024

- Ipsodeckso – Risky Business - 23rd January 2024

- Review – Luma World Games - 15th December 2023

Be the first to comment